#Cashflow 101 plus#

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is UK£2.6b. We discount the terminal cash flows to today's value at a cost of equity of 5.7%. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 0.9%. We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. ("Est" = FCF growth rate estimated by Simply Wall St) Present Value of 10-year Cash Flow (PVCF) = UK£920m Present Value (£, Millions) Discounted 5.7%

#Cashflow 101 free#

We do this to reflect that growth tends to slow more in the early years than it does in later years.Ī DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we discount the value of these future cash flows to their estimated value in today's dollars: 10-year free cash flow (FCF) forecast We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. To begin with, we have to get estimates of the next ten years of cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase. We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company's cash flows. Anyone interested in learning a bit more about intrinsic value should have a read of the Simply Wall St analysis model.Ĭheck out our latest analysis for Rotork Is Rotork Fairly Valued? We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios.

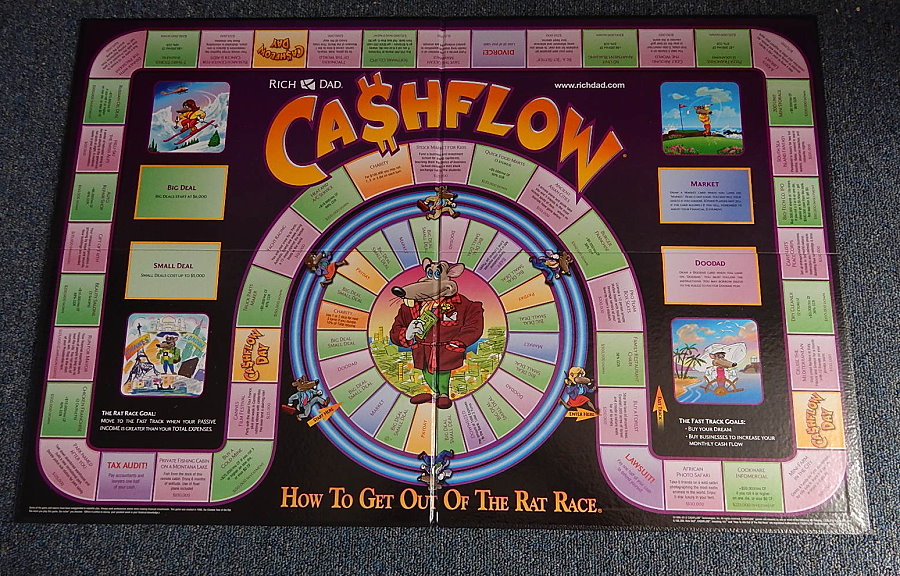

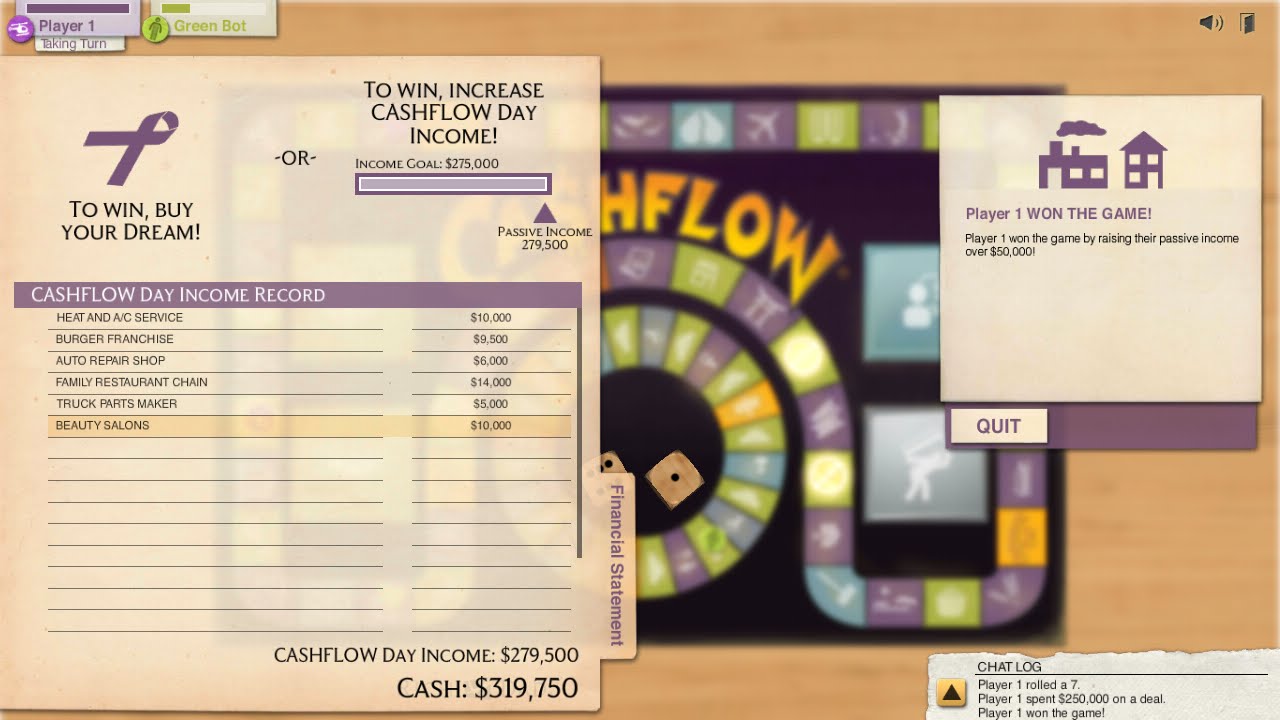

There's really not all that much to it, even though it might appear quite complex. We will take advantage of the Discounted Cash Flow (DCF) model for this purpose. Are you typically a risk taker? Maybe try steady growth.In this article we are going to estimate the intrinsic value of Rotork plc ( LON:ROR) by taking the forecast future cash flows of the company and discounting them back to today's value. Are you typically a saver? Try out aggressive investing. Sharpen your financial literacy and hone the concepts of investing and money making. As you play you’ll learn about yourself, your financial style and how it matches up against your opponents. Playing CASHFLOW will train you to become wealthy and change your life forever. That doesn’t mean you’re stuck with one mindset, it just means you need to play and practice until you find a winning strategy both on the board and in the real world. We all like to think we’ll make the right moves when our big opportunity comes up, but the truth is some of us are conservative and some are risk takers.

#Cashflow 101 how to#

Not only does CASHFLOW coach you on how to secure assets and invest money correctly, your investing personality will be revealed, how you act in the game also reflects on how you react in real life. CASHFLOW 101 is different and unique from other money making and resource management games.

0 kommentar(er)

0 kommentar(er)